colorado estate tax form

Create Legally Binding Electronic Signatures on Any Device. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein.

In 1980 the state legislature replaced the.

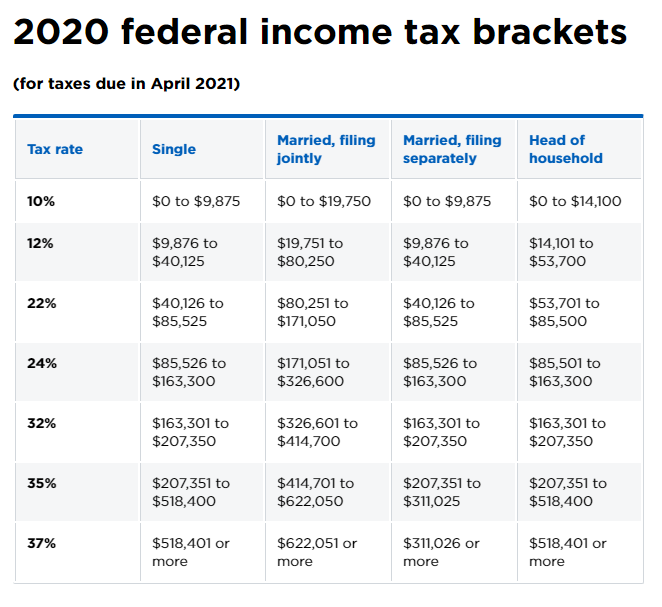

. May increase with cost of living adjustments. For 2020 a filing is required for estates with combined gross assets and prior taxable gifts exceeding 1158 million. The rate threshold is the point at which the marginal estate tax rate kicks in.

Complete Edit or Print Tax Forms Instantly. Form DR 1210 is a Colorado Estate Tax form. Property Taxation - Declaration Schedules.

Estates in excess of 5250000 are taxed at the rate of 40 on the overage. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. We will update this page with a new version of the form for 2023 as soon as it is made available by the Colorado government.

Yes estates are required to obtain a tax id. Ad Access IRS Tax Forms. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022.

A federal estate tax return can be filed using Form 706. DR 0105 - Colorado Fiduciary Income Tax Return form only DR 0158-F - EstateTrust Extension of Time for Filing DR 0253 - Income Tax Closing Agreement DR 0900F - Fiduciary Income Payment Form DR 1210 - Colorado Estate Tax Return DR 8453F - Fiduciary Income Tax Declaration for Electronic Filing Estimated Payment Forms. We last updated Colorado DR 0105 in March 2022 from the Colorado Department of Revenue.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Colorado government. Each county assessor has a different application. Other Colorado Estate Tax Forms.

Ad Download Or Email CO DR 2667 More Fillable Forms Register and Subscribe Now. In other words when an estate is passed on the federal government taxes the transfer. Seniors andor surviving spouses who qualify for the property tax exemption must submit an application to their county assessors between January 1st and July 15th of the year you qualify.

Of these states Maryland imposes both taxes. Look for your contact information for your county assessor here. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Use schedule e on the fiduciary income tax return dr 0105 to make the apportionment. For 2015 a filing is required for estates with combined gross assets and prior taxable gifts exceeding 543 million. Open an Estate Forms.

11-0001 Form 204 - Estimated Income Tax Underpayment Form If you failed to pay or underpaid your estimated income taxes the previous tax year you need to fill out Form 204 to calculate and pay any penalties or fees owed. Most simple estates such as cash or a small amount of easily valued assets do not require the filing of an estate tax return. The decedent and their estate are separate taxable entities.

State Comparisons In 2020 11 states plus Washing DC levy estate taxes and six states levy inheritance taxes. Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as. Using the Current Assets List the principal can enter a description of all items presently part of their estate.

JDF 205 - Motion to File Without Payment of Filing Fee or Waive Other Costs Owed to the State and Supporting Financial Affidavit Download PDF Download Word Document Revised 0521 JDF 206 - Finding and Order Concerning Payment of Filing Fees Download PDF Download Word Document Revised 0521 JDF 711 SC - Notice of. Application forms are available from the Colorado Department of Military and Veterans Affairs Division of Veterans Affairs 7465 E. Colorado has no estate tax for decedents whose date of death is on or after January 1 2005.

Ad Register and Subscribe Now to work on your CO DR 0104CR more fillable forms. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who. 11-0001 Form 104PN - Nonresident Income Tax Return.

We last updated Colorado Form DR 1210 in January 2022 from the Colorado Department of Revenue. PdfFiller allows users to edit sign fill and share all type of documents online. Note however that the estate tax is only applied when assets exceed a given threshold.

This form is for income earned in tax year 2021 with tax returns due in April 2022. The estate tax is a tax applied on the transfer of a deceased persons assets. DR 0002 - Colorado Direct Pay Permit Application DR 0084 - Substitute Colorado W2 Form DR 0102 - Deceased Taxpayer Claim for Refund DR 0104EP - 2022 Individual Estimated Income Tax Payment Form DR 0145 - Tax Information Designation and Power of Attorney for Representation DR 0810 - Employees Election Regarding Medical Savings Account.

Taxes 15-14-739. Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value. Step 3 Create a List of Assets.

Colorado has a flat income tax rate of 463. Even though there is no estate tax in Colorado you may still owe the federal estate tax. Youll want to make sure though that the financial advisor you.

In colorado there is no state or federal death taxes if the decedents estate is 5250000 or less. Their telephone number is 303 343-1268. DR 0105 - Colorado Fiduciary Income Tax Return form only DR 0158-F - EstateTrust Extension of Time for Filing DR 0253 - Income Tax Closing Agreement DR 0900F - Fiduciary Income Payment Form DR 1210 - Colorado Estate Tax Return DR 8453F - Fiduciary Income Tax Declaration for Electronic Filing Estimated Payment Forms.

Included in the list should be a summary of the principals real estate personal property financial accounts business ownership and other notable assets. You might want to consider getting professional advice in the form of a financial advisor. Colorado 2 withholding form and instructions.

Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed. A federal estate tax return can be filed using Form 706. 1st Avenue Suite C Denver CO 80230.

For 2021 this amount is 117 million or 234 million for married couples. DR 0104EE - Colorado Easy Enrollment Information Form DR 0104EP - Individual Estimated Income Tax Payment Form DR 0104PN - Part-Year ResidentNonresident Tax Calculation Schedule DR 0104TN - Colorado Earned Income Tax Credit for ITIN Filers DR 0104US - Consumer Use Tax Reporting Schedule DR 0104X - Amended Individual Income Tax Return. Other Colorado Estate Tax Forms.

Property Taxation Forms General Forms Certification of Valuation Personal Property Declaration Schedules Mobile Equipment Form 301 Personal Property Appraisal Record Form AR 290 Oil and Gas NERFSIRF NERF Spreadsheet Real Property Real Property Transfer Declaration TD-1000 Real Property Transfer Declaration Completion Guide TD-1000. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Colorado estate tax form.

Start estate tax id ein application.

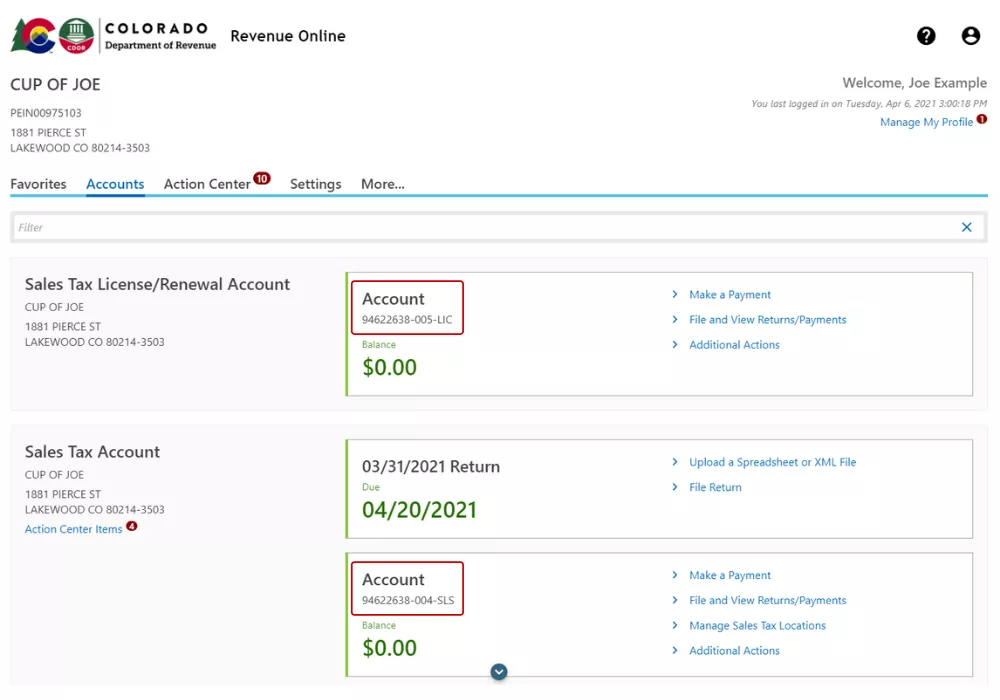

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Financial Tip Of The Month Tax Prep Checklist Tax Prep Checklist Tax Prep Small Business Tax

7 Mistakes To Avoid When Building A Home In Colorado Sheffield Homes Home Inspection Listing House Building A House

Prepare And Efile Your 2021 2022 Colorado State Tax Return

Tax Rates Stranger Tallman Lautz Accounting Grand Junction Colorado

Colorado Estate Tax Everything You Need To Know Smartasset

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Gov Jared Polis Signs New Property Tax Law Gasoline Fee Delay

Colorado Civil Litigation Lawyer Civil Lawsuits Keating Lyden Llc Litigation Litigation Lawyer Civil Lawsuit

Free Colorado Tax Power Of Attorney Form Dr 0145 Pdf Eforms